Thank you from stocktube.blogspot.com

Globalization seems to be the magic bullet which is slowly but surely taking its effect on everyone including the world of stocks investing. When I first started StockTube about slightly more than a year ago, I wasn’t too sure if I should write about the hidden opportunity in investing not only stocks but also option from the world’s largest equity markets – the United States. Since then I’ve received great response (surprisingly most of the readers decided to send me private email instead of using the comment section) particularly the mechanism of option trading.

One thing leads to another and due to overwhelming requests (I was bombarded with emails for related articles for quite some time) I’ve written the article on which broker to choose and how to open a trading account. Surprisingly I continue to receive emails from readers (who can blame them *grin*) asking me how to fund their accounts. Hey! I thought funding the account should be a straight-forward process that the local banking institutions have no problem executing. Isn’t it strange that Malaysian local banks such as Maybank and Public Bank do not know how to do simple TT (Telegraphic Transfer) to USA? But then maybe it only affects certain branch(s) of which their officers have not done such a high-tech procedure before *evil grin*.

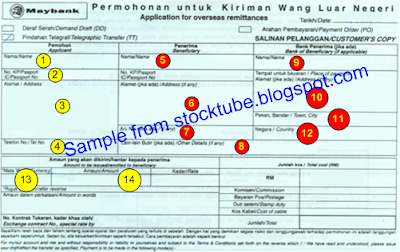

As such, I’m publishing this short article on steps to fill in the “Application for overseas remittances” form or most of you would refer it as “TT form” (applicable to Malaysian investors only). The example below is based on Malayan Banking Berhad’s (KLSE: MAYBANK, stock-code 1155) form. Take note that this form might have changed. Other financial institutions that offer such facility should have different form but the basic fundamental of the contents should be almost the same. Here’s the extract of the form (I’ve ignored the rest of the no-brainer particulars within the actual form).

Particulars of Applicant:

- [Step-1] - Your Name: you shouldn’t have problem with this else I do not know what to say.

- [Step-2] - IC / Passport No: your identification number or passport number for non-citizen

- [Step-3] – Address: your residential or mailing address

- [Step-4] - Telephone No: your contact number which is reachable

Particulars of Beneficiary (the most important):

- [Step-5] – Name: the Bank Account Name of the broker that you’re applying, i.e. Interactive Brokers LLC. You should be able to get this information when you sign-up with your preferred broker.

- [Step-6] – Address (if any): this is the address of the broker’s banking, i.e. Citibank, N.A. (New York Branch), 111 Wall Street, New York, NY 10043, United States of America. Again this info should be supplied to you by your preferred broker when you sign-up.

- [Step-7] – Account No: this broker’s bank account number should be available during your preferred broker’s sign-up

- [Step-8] – Other Details (if any): you should enter the information provided by your broker with reference (benefit to) to you.

Particulars of Bank Beneficiary (important):

- [Step-9] – Name: the name of the broker’s bank, i.e. Citibank, New York

- [Step-10] – Place of payment / Address (if any): this should be the “Bank Codes” provided by your broker, i.e. ABA Number and the SWIFT BIC Code.

- [Step-11] – Town, City: the city of your broker’s bank location, i.e. New York

- [Step-12] – Country: you should enter United States of America.

Amout to be remitted to beneficiary:

- [Step-13] – Currency: USD

- [Step-14] – Amount: 3,000,000.00 (if you wish to fund such amount *grin*)

That’s almost all you need to fill with the remaining to be taken care by the bank’s officer. If your local bank officer still scratching his/her head while giving you a clueless look, it’s time to kick his/her butt. Let me know if this article is useful to you, will ya?

Related posts: Which Brokerage and How to open a trading account?

No comments:

Post a Comment